Navigating the Future: Assessing Virtual Assistant’s Effect on Agency Efficiency and Client Satisfaction

Technology adoption has long been seen as the cornerstone of efficiency and innovation within the insurance industry, particularly virtual assistants explicitly tailored for insurance agencies. In this article, we investigate its definition and significance within an insurance agency setting by exploring their essential functions, impact on productivity, applications across different products as well as integration of advanced technologies, security compliance considerations as well as challenges encountered during the implementation process, real-world success stories of virtual assistant integration as well as insights into its future landscape of implementation in insurance agencies.

Key Benefits of Virtual Assistants for Insurance Agencies

Optimizing Customer Interactions and Communication: Virtual assistants play an essential role in streamlining customer interactions and communication at insurance agencies by quickly accessing customer details such as policy details, contact info, and communication history – helping agents provide more informed and tailored client interactions that build more robust and more meaningful client-agent relationships.

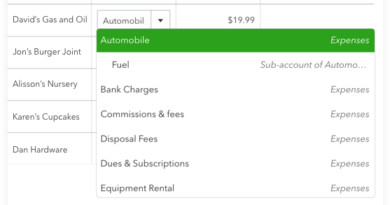

Automating Routine Administrative Tasks to Enhance Operational Efficiency: Virtual assistants are invaluable in streamlining routine administrative duties for operational efficiency. From data entry, document submission, appointment scheduling, and more – virtual assistants automate tedious and time-consuming administrative processes so professionals can focus on higher priority, value-driven activities.

Enhancing Claims Processing Support and Client Satisfaction: Claims processing is one of the primary responsibilities of an insurance agency, making virtual assistants invaluable resources in terms of providing support in claims processing, providing real-time updates to clients on claim statuses, as well as more responsive service that leads to greater client loyalty and satisfaction. This, in turn, leads to enhanced client retention rates.

Personalized Policy Recommendations for Clients: Employing advanced machine learning algorithms, virtual assistants analyze client data to provide personalized policy recommendations tailored to meet each individual’s unique requirements – aiding agents in providing tailored insurance solutions more focused around meeting each client’s unique requirements and leading to a client-centric approach from agents.

The Impact on Agency Productivity

Accelerating Claims Processing for More Responsive Service: Virtual assistants have made significant strides toward increasing agency productivity by speeding up claims processing and streamlining claims management operations, drastically cutting manual workload and errors, and providing responsive customer services – ultimately increasing overall customer satisfaction.

Automation to Maximize Agency Resources: Virtual assistants provide insurance agencies the means to optimize their resources through automating administrative duties like data entry, document submissions, and other administrative duties that take up precious agent time that could otherwise be dedicated towards strategic client interactions and activities. These digital companions handle data entry and document submissions and more efficiently allocate them all among agents so they have more time for client engagement activities and activities focused on client strategies and client services.

Improve Customer Service and Loyalty: Virtual assistants are instrumental in increasing customer service quality and client loyalty, leading to higher retention rates, positive word-of-mouth referrals, and marketing campaigns. In particular, virtual assistants are integral in forging strong client-agent relationships that ensure continued business relations between agents and clients.

Real-World Examples of Increased Productivity through Virtual Assistant Integration: Numerous insurance agencies have seen remarkable productivity increases through successfully incorporating virtual assistants into their daily operations, increasing efficiency in client interactions, claims processing, task management, and overall task completion. These real-world examples showcase how a virtual assistant increases agency productivity and efficiency.

Tailoring Virtual Assistants to Different Insurance Lines

Virtual Assistants in Property and Casualty Insurance: For agencies offering property and casualty policies, virtual assistants help streamline claims related to property damage or liability claims. These digital companions support clients during this process while offering assistance when required and guaranteeing efficient communication throughout.

Virtual Assistants in Life and Health Insurance: Life and health insurers utilize virtual assistants for policy analysis, personalized recommendations, claims support services, and wellness program info – ultimately improving client experiences.

Adjusting Virtual Assistant Functions to Meet the Requirements of Different Insurance Products: Thanks to virtual assistants’ adaptable nature, insurance agencies can adapt their functions according to each product line’s particular needs – be they auto, home, health, or specialty policies. Virtual assistants provide tailored support to meet each product line’s distinct demands.

Integrating AI and Advanced Technologies Into Insurance Agencies

Leveraging Natural Language Processing for Client Interactions: Virtual assistants utilize natural language processing technology for more conversational interactions with their clients, making their interactions more naturalistic while improving overall customer experiences and aiding agents to communicate more efficiently.

Machine Learning to Generate Customized Policy Recommendations and Cross-Sell: Machine learning algorithms analyze client information, such as past interactions and preferences, to generate custom policy recommendations that help agents offer tailored solutions while creating cross-selling and upselling opportunities that drive revenue growth.

Predictive Analytics to Support Proactive Client Service and Risk Management: Modern virtual assistants utilize predictive analytics to accurately price policies while helping agents proactively address potential risks to provide more proactive client service and increase overall client satisfaction. This also leads to improved risk management and greater client satisfaction overall.

Security and Compliance Considerations of Virtual Assistant Systems

Protection Measures Implemented by Virtual Assistant Systems: In response to security concerns, virtual assistant systems implement stringent data protection measures like secure encryption protocols, access controls, and secure storage for sensitive client information.

Compliance With Industry Regulations: Virtual assistants operate within an established set of industry regulations and compliance standards, so adherence to any regional or industry-specific rules or restrictions is crucial in maintaining client trust and fulfilling any legal requirements.

Establish Trust Through Transparent Data Handling Practices: Trust is essential when building client relationships in the insurance industry, so open communication about how client data is managed, stored, and utilized helps create an atmosphere of security among clients working with virtual assistants.

Implementation of Virtual Assistants in Insurance Agencies: Issues and Solutions

Addressing Concerns Regarding Data Security and Privacy: Insurance agencies seeking virtual assistant solutions often express anxiety over data security and privacy. Insurers can alleviate such worries by selecting reliable virtual assistant systems with robust security features that offer transparent handling practices of customer information.

Overcoming Resistance to Technology Adoption in Traditional Insurance Practices: Insurance agencies may experience resistance when adopting new technologies due to traditional industry practices. Communicating about their benefits, successful case studies, and gradual integration strategies may help overcome resistance.

Virtual Assistant Systems Require Continuous Training and Updates: Virtual assistant systems require ongoing training and updates to comply with evolving insurance policies, industry regulations, and technological advancements. Regular audits and quality checks help maintain accuracy and compliance while contributing to accuracy and compliance in service provision.

Real-world Success Stories and Case Studies of Insurance Agencies

Agencies Leveraging Virtual Assistants for Increased Efficiency: Numerous insurance agencies have successfully integrated virtual assistants into their daily operations and experienced increased efficiency with client interactions, claims processing, and task management – thus reaping the tangible rewards of having virtual assistants implemented into daily operations. Here are several real-world success stories of virtual assistant adoption for an insurance agency.

Examples of Successful Policy Recommendations and Claims Processing: When virtual assistants have played an instrumental role in helping produce successful policy recommendations, speedy claims processing, or enhanced client relations within insurance agencies, their benefits become evident.

Positive Impacts on Overall Productivity and Client Relations: Implementing virtual assistants has several significant advantages regarding client relations and overall agency productivity. Automating routine tasks relieves administrative load so agents can spend more time building meaningful client relationships.

Future Trends for Integration of Virtual Assistants into Insurance Agencies

Advancements in AI for Further Agency Support: Artificial intelligence holds great promise as virtual assistants perform more complex functions to support insurance agencies, including advanced client analytics, predictive client service delivery, and nuanced risk management strategies.

Expansion of Virtual Assistant Capabilities across Diverse Insurance Products: Virtual assistant capabilities will likely expand across a wide variety of insurance products, possibly by creating tailored virtual assistants for each product line that provide tailored functions to them.

Integrating Emerging Technologies for an Easy Agency-Client Experience: Emerging technologies such as augmented and virtual reality may be integrated with virtual assistants to provide an even smoother agency-client experience, revolutionizing how insurance agencies engage clients while making processes more engaging and efficient. This could revolutionize how insurance agencies engage their client base – opening doors to an entirely new era of engagement between insurers and clients!

Conclusion

Virtual assistant integration into insurance agency operations represents a dramatic paradigm shift within the industry. Beyond mere automation, virtual assistants serve as catalysts of efficiency, client satisfaction, and future innovation – with adoption being vital in unlocking higher productivity levels and client engagement levels for insurance agencies navigating this turbulent timeframe.